Have scammers contacted your customers and used your brand name and positive reputation to trick them into fraudulent schemes? Perhaps offering fake tech support, warranties, or refunds for bogus software? These are all techniques scammers employ to pass as legitimate offers. In reality, they are collecting your customer’s sensitive information.

It’s becoming increasingly common to get robocalls, spam or phishing emails, and even unsolicited text messages from unscrupulous individuals. These bad actors are hoping to take advantage of people’s loyalty to their favorite brands and their trust in authorities. Now more than ever, it’s important for brands to establish a consumer reporting program to identify the scams that are using their good name and reputation to trick consumers.

When scammers communicate with your customers as legitimate brand representatives, it can have a severe negative impact on your reputation. It can also prevent repeat business from victimized consumers. Additionally, some customers may never realize they were tricked and they may blame the brand for poor or non-existent services.

But, as a reputable brand, how are you to know when your customers are being targeted by scammers? New scams are always emerging. So it’s not uncommon for customer and technical support staff to lack the training needed to field calls and inquiries from confused customers impacted by these schemes. And unfortunately, by the time the media covers these scams, the damage has already been done. This puts the brand on the defensive.

However, providing a mechanism for consumers to report scams using your brand name will create a funnel. It can provide valuable intel and result in a better understanding of your reputational risks in the marketplace. In addition, the information obtained can be used to educate others. So, it can help protect your customers. It can also be shared with the authorities to identify those responsible, develop leads, and disrupt further schemes.

Keep reading to see our recommendations for building a consumer reporting program.

Educate Your Customers

The first step to setting up a consumer reporting program is to educate your customers. Provide information on your business and legitimate service offerings. Make technical and customer support information easy to find. Then customers won’t have to look elsewhere where they could stumble on outdated or fake material.

Scammers often use confusing language, threats of urgency, and ignorance of standard privacy and security procedures to extract information from their victims. Therefore, providing knowledge and raising awareness of how your brand does business will build consumer trust. And it will reduce the chances that your customers will fall victim to these scams in the future.

Create a Process for Scam Reporting

The next step is creating a standardized reporting mechanism. This will provide the means for a data-driven approach to fighting these reputation risks. Consumer scam reporting does not have to be complicated. It can be as simple as a fillable form located on your customer-facing website or an automated hotline where customers can leave tips.

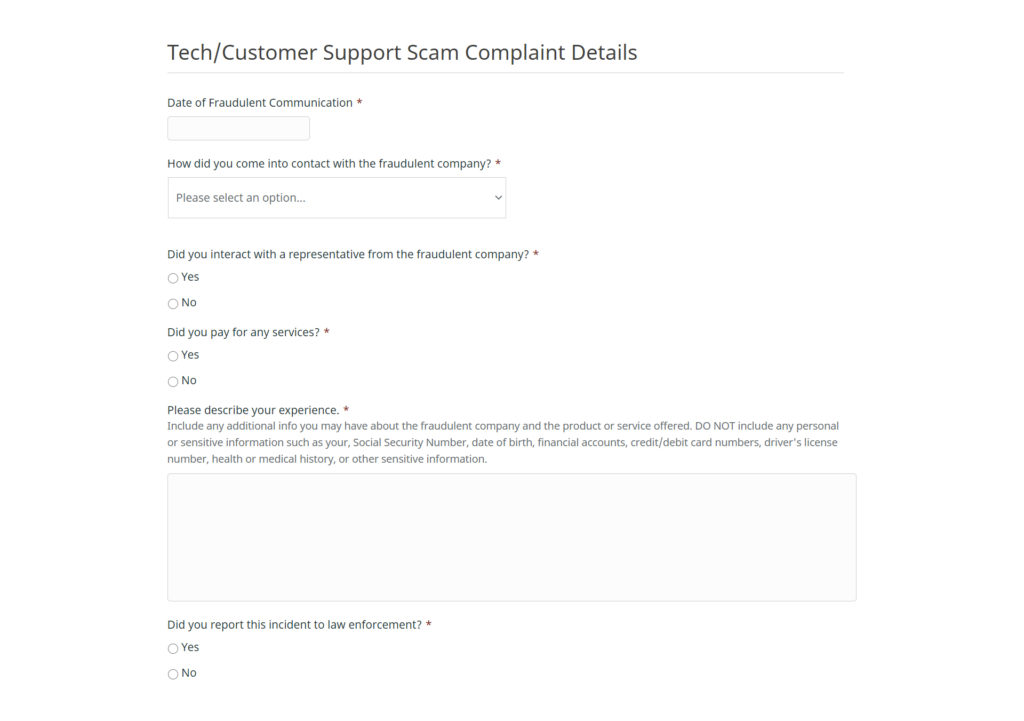

To provide an example of what this could look like, we built a sample consumer reporting tool. The tool is interactive. By clicking in the drop-down fields, you can see the types of information that can be collected using a fillable form on your website. Here’s an image of the section that captures details on the scam:

The reporting tool should be easy for your users to understand and use. It should be customizable so it can adapt to changing scenarios. And it should utilize a standard format. This will make sorting and analyzing the information received easier.

The information collected via such a tool can be invaluable to your internal security team and potentially even law enforcement. It will help you better understand the latest scam techniques while combing for leads, security leaks, and even insider threats. Such information also complements threat intelligence efforts. And, of course, it could provide an early warning of potential reputation risks.

Assess Privacy & Security Protocols

Another important step while developing a reporting program is to analyze internal policy to close gaps in company privacy and security guidelines and protocols. All the reputation management and threat tracking could mean nothing if your company is already employing risky processes or letting sensitive consumer data leak. Perhaps the customer service department could benefit from an update on the handling of customer credit card data over the phone and on company systems. Or the technical support representatives could use a refresher on the risks associated with allowing a customer account reset without proper authentication.

Comprehensive physical and cybersecurity policies are vital to prevent malicious actors from exploiting your customers or compromising their information.

Exercise Legal Rights

Finally, it is vital that businesses exercise their legal rights to hold accountable those who fraudulently represent themselves. A business may utilize cease and desist letters, civil litigation, and or intellectual property rights enforcement to stop and deter these abuses. These legal means can provide relief from scams and potentially provide a source of compensation to your business and customers.

In some recent cases pursued by the United States Federal Trade Commission, judgements have been made against scam operators to stop illegal business practices and refund customers who lost money. Over the last several years, the FTC has returned nearly $11 billion to impacted customers in the United States.

Sharing enforcement information in a transparent way also shows your customers and shareholders you are doing everything possible to protect them. On the other hand, lack of action can damage a brand’s image and encourage imitators who feel they can act with impunity. Having a consumer reporting program provides a better picture of a businesses’ threat landscape while helping manage brand risks and meet customer expectations in the digital age.

Today, many consumers expect their favorite brands to protect their hard-earned intellectual property and brand reputations from scammers and imitators. Those companies that fail to do so risk alienating their customers and tarnishing the legitimacy of their name, products, or services. Developing a robust consumer reporting program shows your customers you are proactive in addressing these risks and willing to engage with the community to better protect them.

written by

Alec Simpson

November 11, 2020

Stay informed with industry-relevant emails curated by our team of experts.

We send out emails once or twice a month relating to IP Services, industry news, and events we'll be attending so you can meet our experts in person.

Alec Simpson

Alec Simpson is a trained risk management professional with a keen interest in keeping markets safe and secure for consumers. After earning a degree in Economics, he gathered experience working in the banking & insurance industries before joining the brand protection team at IP Services. Local legends say he is a foosball wizard.