A chargeback can be an important consumer protection, but it can also be a huge hassle for ecommerce businesses. If you’re a merchant, you’re probably already familiar with the chargeback process.

If a customer is dissatisfied with a product they’ve been sent or service they’ve received (or if they failed to receive a product or service they paid for), they can work with their bank to request their money back via a chargeback. This used to be done by phone call, but it’s usually now initiated with the click of a button on the customer’s banking or credit card app.

The right to initiate a chargeback stems from the 1974 Fair Credit Billing Act (FCBA), which, according to Cornell Law School, requires “creditors to give consumers 60 days to challenge certain disputed charges over $50 such as wrong amounts, inaccurate statements, undelivered or unacceptable goods, and transactions by unauthorized users.” But while we all agree that chargebacks have an important place in the ecommerce industry, they can become a significant barrier to a merchant’s ability to do business if left uncontrolled. The merchant loss from chargebacks is estimated to be $100 billion in 2023!

Why Do Customers Initiate Chargebacks?

According to the Merchant Fraud Journal’s Chargebacks Consumer Survey Report, some of the most common reasons for chargebacks are:

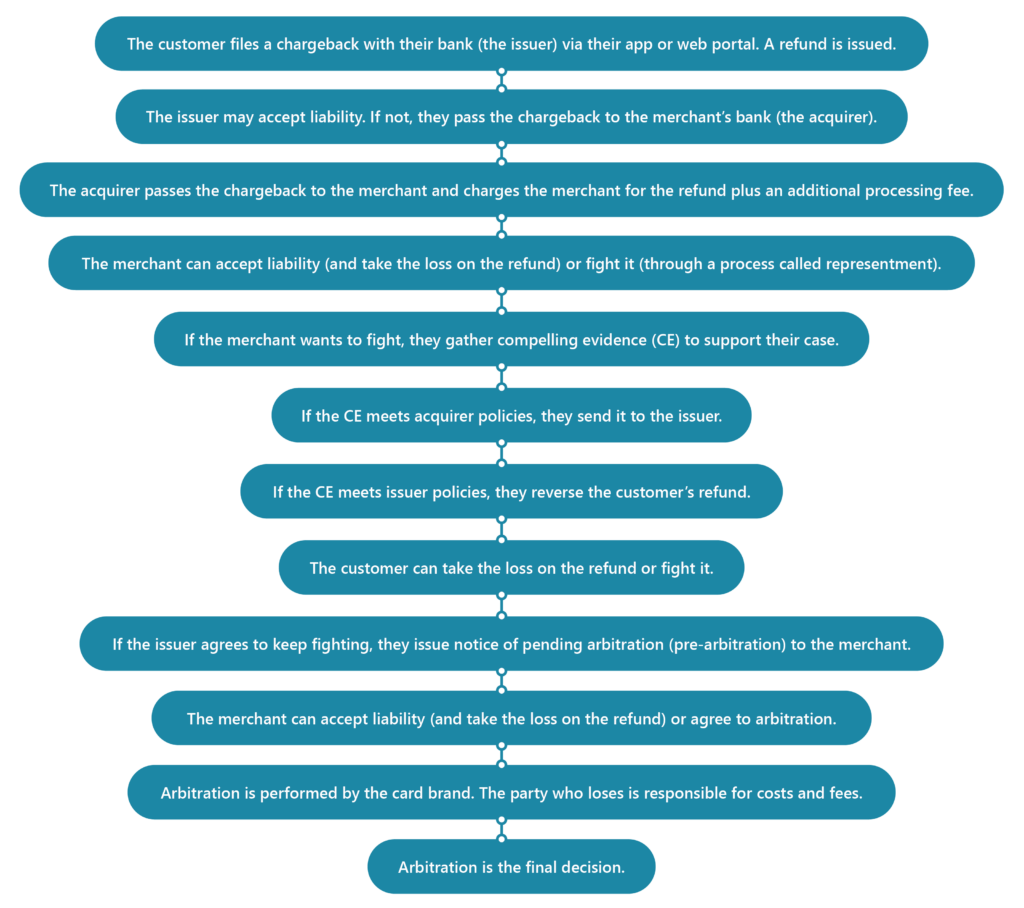

The Chargeback Process

The chargeback process can be difficult to understand because of its many layers, but it can generally be broken down into just a few steps:

How do Chargebacks Hurt Your Business?

As you can see from the process listed above, there could potentially be a lot more money at stake than the cost of the original product. The first thing to highlight is that chargeback fees (charged by the acquirer to the merchant) are non-refundable. These fees are generally between $20 and $100 per chargeback, and that’s money your business won’t get back – even if you win the case.

If you proceed to arbitration, you’re also liable for arbitration costs, which could be hundreds of dollars.

None of that is considering the cost of the refund itself, should you either accept liability or lose the case in arbitration. For custom or high-end items, that refund could cost your business thousands of dollars.

There’s also the operational cost of processing a chargeback. Your team will need to gather compelling evidence and format it to be sent to the acquirer for review. This takes time and time is money. Having this evidence available to use also means you’ll have needed to track that evidence throughout the customer’s purchase process. And since you never know which customers may be filing a chargeback, the safest move is to track everything from every customer. This too takes time from your team, as well as money invested in the infrastructure to support tracking of this kind.

Apart from those costs, there’s also the risk of your business being labeled “high-risk” by the card networks if your company has too many chargebacks. If you exceed a card network’s designated chargeback threshold (this varies by card brand), you’ll be put into a chargeback monitoring program.

These programs incentivize the merchant to reduce chargebacks by charging them a fee per month or per chargeback. Visa, for example, gives the merchant four months in the program at no monthly cost, then initiates a $50/chargeback cost for months 5 to 9 if the chargeback threshold is exceeded in those months. Starting in month ten, the acquirer is eligible for a $25,000 review fee in addition to the fee per chargeback. At this point, Visa may also choose to stop doing business with the merchant. Visa is the world’s largest card network, so as you can imagine, that could be disastrous for a merchant’s business.

The best way to avoid these costs to your business is to keep your chargebacks at a manageable level. Next, we’ll share some tips on how to approach this.

Reducing Non-Fraud Chargebacks

While it’s not possible to completely prevent chargebacks, there are steps you can take to reduce them, including:

- Provide accurate and detailed descriptions of your products and services. If customers are clear on exactly what they’re purchasing, they may be less likely to file a chargeback after receiving the item.

- Keep your return policy simple and visible. Many customers (over 61%, according to this survey) view chargebacks as a good alternative to requesting a refund. Making sure your refund policy is user-friendly and highly visible on your platform should reduce the number of customers using the alternative. The most customer-friendly return policies, according to US News, are risk-free to the customer (“satisfaction guaranteed”), with a robust customer service and a long (up to one year) eligibility period for returns.

- Send out detailed receipts at time of purchase – and a reminder when the item ships. Customers are purchasing online at an unprecedented speed, and it’s entirely possible for someone to make a purchase and then forget about it by the time it arrives in the mail or shows up on their bank statement at the end of the month. By sending customers digital receipts and reminders, you’ll be able to keep the purchase fresh in their minds and hopefully cut down on transaction confusion that may lead to chargebacks.

- Send out reminders about upcoming recurring payments a week to five days before the payment is due. Another common cause of chargebacks is a customer who was charged after having attempted to cancel a service. By sending advanced notice of upcoming recurring payments, you’ll give the customer enough time to contact customer service to confirm cancellation – or to decide they’d like to keep the service active, after all.

- Take advantage of Visa’s Compelling Evidence 3.0 update. We’ll talk more about this in a future blog post.

Reducing Fraud Chargebacks

The best way to reduce fraud chargebacks is to reduce the amount of fraud on your platform. And lucky for you, there’s a well-established way to do this. As we’ve talked about in a previous post, the best way to combat fraud is to combine an AI machine learning model with a human intelligence team to support manual review and drive fraud strategy.

An AI model should be your first line of defense to block any straightforward fraud patterns that try to sneak through. By stopping fraudulent purchases at the gate, you reduce the risk of chargebacks completely as there will be no unauthorized charge for the customer to dispute.

We also recommend building in a slight buffer between customer check-out and when you charge the customer’s payment instrument. This added time will allow your human intelligence team to catch more complicated fraud at the gate. One strategy many companies employ is to not charge a customer’s credit card on physical goods until the item has been shipped (this may also cut down on transaction confusion as a bonus).

Your human intelligence team can also help reduce chargebacks from the other end by handling customer appeals related to unauthorized charges. If your team can provide a quick, painless experience for customers seeking refunds for unauthorized charges, that may greatly reduce the number of customers resorting to chargebacks for refunds. Good customer service can also boost your brand reputation.

3DS2 Benefits and Limitations

Another way of protecting yourself from fraud chargebacks would be to invest in 3-D Secure 2 (3DS2). 3DS2 is an authentication protocol that provides additional verification for ecommerce transactions. Many payment providers already have this protocol established, as it fulfills the Strong Customer Authentication (SCA) requirements under the Payment Services Directive (PSD2), which the European Union and EEA implemented in 2019.

This is a lot of acronyms, so let’s break it down:

If 3DS2 is enabled, a customer who is initiating a transaction may be pushed through a frictionless flow or a challenge flow. In the frictionless flow, the customer’s device ID is verified automatically and the customer is allowed to complete the purchase without being aware that a verification happened at all. In the challenge flow, the customer must manually verify their identity using a password or biometric indicator (like a fingerprint). In some cases, the customer will be redirected to their bank’s app to complete this verification.

The decision between frictionless and challenge flows is determined by the issuer’s risk review, which flows through 3DS2. The issuer then determines if the transaction is authorized from their end. If the transaction is not authorized, the purchase cannot be completed.

Because the issuer is performing the risk review, the issuer assumes chargeback liability for any chargebacks initiated due to unauthorized charges. All the chargeback steps involving the merchant we talked about earlier no longer apply, because the chargeback and refund will be handled by the issuer.

However, this doesn’t mean you’re completely in the clear when it comes to chargebacks! For one thing, this liability shift only applies when it comes to third-party fraud chargebacks. All other chargebacks (including first-party fraud) will still have merchant liability.

Exemptions also aren’t covered by the liability shift. If your system categorizes a transaction as low risk (or meets another exemption to PSD2 requirements), you can bypass 3DS2 entirely, in which case you’d retain chargeback liability.

You may ask why someone would bypass 3DS2 if it means losing the liability shift. That brings us to another merchant concern with this protocol, which is that it can cause customer friction. The frictionless flow is meant to mitigate this, but the challenge flow can cause customers to abandon their carts – especially if they’re required to enter a password that they don’t remember. This means your conversion rates will drop, which is something no merchant wants.

False declines from the issuer can also occur, which would block your customer errantly. According to the Merchant Fraud Journal’s Chargebacks Consumer Survey Report, 33% of customers said they would not return to a merchant if their payment instrument was declined.

Adoption of 3DS2 isn’t universal, either. While it’s required in the EU and EEA and most larger credit card networks have adopted it, smaller card brands and new payment methods may not have.

For all these reasons, it’s crucial that your business continue to maintain a fraud prevention strategy, even if you plan to or already have adopted 3DS2.

To keep your customers safe and to keep your chargeback rates low, your fraud prevention strategy should be driven by an experienced human intelligence team. That, along with the other tips we discussed above, will keep your chargebacks manageable and keep you out of costly card network chargeback monitoring programs.

written by

Tonya Boyer

December 5, 2023

Stay informed with industry-relevant emails curated by our team of experts.

We send out emails once or twice a month relating to IP Services, industry news, and events we'll be attending so you can meet our experts in person.

Tonya Boyer

Tonya has been with IP Services since 2014. After several years serving as a Subject Matter Expert in the cloud computing space, she began managing the Fraud Protection team in 2017. She believes in creating a happy, casual but professional workspace where everyone can live their best lives while doing good work. She is dedicated to community outreach and helps coordinate the IPS Connects volunteer and donation committee.